Food & Drink – France, Belgium, Netherlands Update – 2020

Protel tracks capex project activity across the main process sectors to help suppliers win new business. In this article, we aim to outline the future outlook of one of our areas of coverage. In this case, we look at the current and future picture for the food and drink sectors in France, Belgium and the Netherlands.

Food & Drink Capex Project Coverage – 2020 Update

Project pipeline healthy despite sluggish initial period for food & drink in 2020

In our previous article, we covered how the picture was mostly positive for the food and drink sectors across our newly covered regions of France, Belgium and the Netherlands. Since then, the project pipeline has grown hugely, with new and in progress capex project schemes at a good level. See our current coverage for yourself.

However, the industry has not escaped the global economic slowdown and faces many challenges in 2020 and beyond. In general, confidence across all three countries remains lower than previous. Now with the added challenge of the Coronavirus outbreak the outlook is likely to worsen slightly over the short to medium term, depending on the extent to which construction restrictions apply in France, Belgium and the Netherlands.

Companies are still making procurement decisions and equipment continues to be delivered to site. This continues for a range of project types, including efficiency, optimisation, servicing or replacement of parts, modernisation, upgrades or production capacity expansion, although the pace at which things are progressing is slower. A major challenge however is for people to go on to site. This has has a knock on effect on front end workfor new projects and the commencement of new construction.

The nature of the food and drink sectors means that in general the project pipeline may slow due to Covid-19, but there is still a large amount of capex either planned or underway in 2020. Whether construction is restricted or not, suppliers must ensure they are using time to build new relationships and broaden their network ready to capitalise on when projects begin to move apace again later in the year. Request a call from one of our team to discuss a tailored subscription option,

Merger and acquisition activity has slowed down, although we are seeing a large amount of capex related to organisations seeking to focus on innovation after acquiring start up businesses.

Trends

Ingredients are an area of significant capex across the three countries. Environmentally focused consumer behaviour continues to drive investment, with a focus on by-products, sustainability, plant-based meat alternatives and alternative protein products set to continue in 2020.

Manufacturers seek to improve efficiency and sustainability, dairy being one such area seeking to drive forward in capturing added value from derivatives. Packaging improvements and recyclable alternatives are also an area of focus across food and drink producers.

Future Outlook

We are anticipating fewer new-build projects to be entering the pipeline as engineering resource remains tied up in implementation. Construction is, in the main, still occurring, and as such it is imperative to keep up to date with the projects which are progressing. There is expected to be a ‘rebound’ of new-build activity once the current crisis eases, although the timescale on this remains subject to rapid change.

Our Coverage

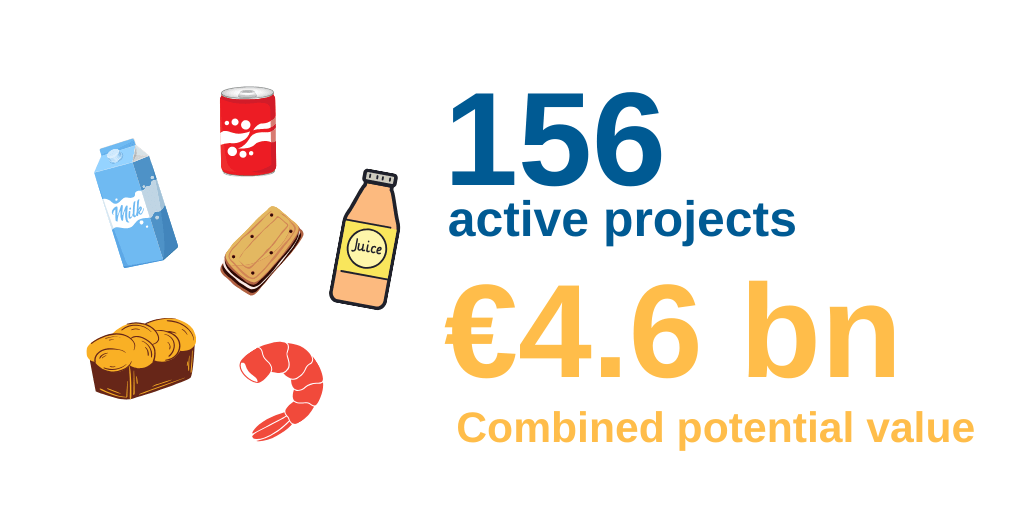

On our project search engine, MyProtel, we are currently covering 156 active food and drink projects. These projects have a combined potential capex value of just over €4.6bn. Full details on all of these project opportunities are available to subscribers. Request a free sample bulletin.

Conclusion

While confidence is slightly lower than the previous year, there still remains large amounts of potential for providers of capital equipment and services in the food and drink sectors. Across France, Belgium and the Netherlands we are reporting on a large volume of progressing capex project schemes of varying sizes, though the average project has a procurement value of just over €29bn.

While uncertainty around construction and implementation persists, it is likely that projects will move quickly where sanction is given and resources are available, at such it is wise to monitor new information closely to ensure the right timing of approach.

For more information on our project coverage and subscription options, please contact us.