Capex Project Procurement Analysis – Process Sectors – 2018

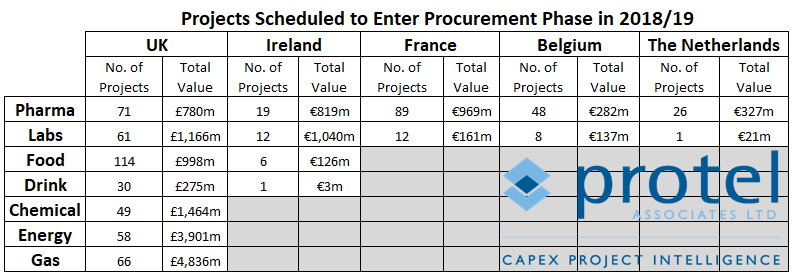

In this post, we take a look at some project procurement statistics from our MyProtel project database as we move toward 2019. Read the chart and analysis below to get our take on potential capex project procurement levels in the main processing sectors for the next year.

Pharmaceutical & Biotechnology

Compared to our previous post covering 2017, we are seeing a greater number of projects schemes entering procurement in the next 12 months, albeit at a lower total potential investment value.

Due to the need to ensure ongoing product integrity and the need to meet regulatory compliance, pharmaceutical and biotech manufacturers are constantly investing in capital equipment. The split of project sizes (see Fig. 1 below) is even further biased toward smaller schemes than previously reported, as political uncertainty has impacted on larger-scale new build type projects.

The trend toward large R&D schemes has also changed the investment horizon, with a much larger amount of laboratory activity for 18/19 entering procurement than in the previous period.

We are expecting a number of these projects to be placed on hold as they are impacted by the general uncertainty impacting the sectors (read more in our latest UK Pharmaceutical Industry Outlook here).

In Ireland we’ve seen large schemes come to fruition, which has left a lower amount of investment reaching procurement this year, though we are seeing good levels of new projects entering the pipeline at a planning stage.

France bucks the trend slightly, with a larger potential capex value split across fewer schemes, the size of individual schemes reflecting larger-scale project activity in general.

Food & Drink

In the UK, there seems to large amount of investment reaching procurement stage in the coming year, which could represent an excellent opportunity for suppliers.

Potential investment value and quantity of projects are both higher than in the previous period. Further, this investment is split across a greater number of organisations and sites.

Chemical, Energy & Gas

As previously mentioned, these 3 sectors are greatly linked across our coverage: over two-thirds of reported energy projects involve some form of chemical and/or gas related process, such as anaerobic digestion or pyrolysis, producing biogas or syngas. While project scale varies dramatically (especially compared to our other industries – see Fig.1), almost all reported Energy projects are new builds with a value in excess of £10m.

Chemical projects remain more varied: biased more toward the middle bands (£10m-£50m). There are a good number of mid-scale chemical plant expansions entering procurempoent in 2018, full details of which are available to subscribers. As with the last period, total investment value across all 3 sectors is dominated by a relatively low number of big budget schemes.

Conclusion

The mix of projects entering procurement in 2018-2019 has changed from 2017. There is still a great deal of potential for suppliers of equipment and related services, across multiple regions. However, suppliers must be mindful of the changing investment landscape, in certain sectors shown as a greater number of smaller schemes, but in different sectors or regions the opposite is occurring, depending on the individual market conditions.

Overall, we’re tracking a very consistent amount of investment due to enter procurement this year, albeit across a different quantity of projects. It’s worth noting that we would likely expect the great political uncertainty (particularly in the UK) to mean that a higher proportion of these projects experience delays.

Fig 1. Split of Projects by Sector & Value Band – UK & Ireland

| £0m-£5m | £5m-£10m | £10m-£25m | £25m-£50m | >£50m | |

| Pharma | 47% | 21% | 15% | 13% | 3% |

| Food & Drink | 46% | 33% | 14% | 6% | 1% |

| Chemical, Energy & Gas | 12% | 22% | 24% | 17% | 25% |

For full details of any of the investment covered, including key information required to target specific projects, please contact us – we’ll help you to win new business.